40 rich dad poor dad assets liabilities diagram

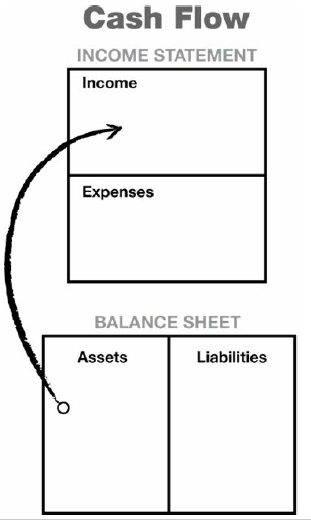

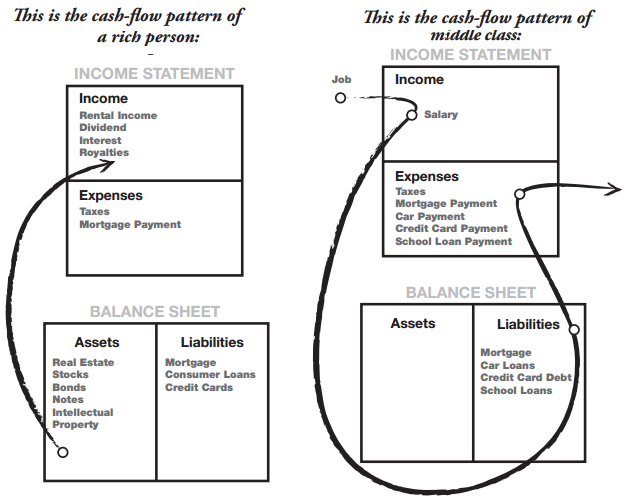

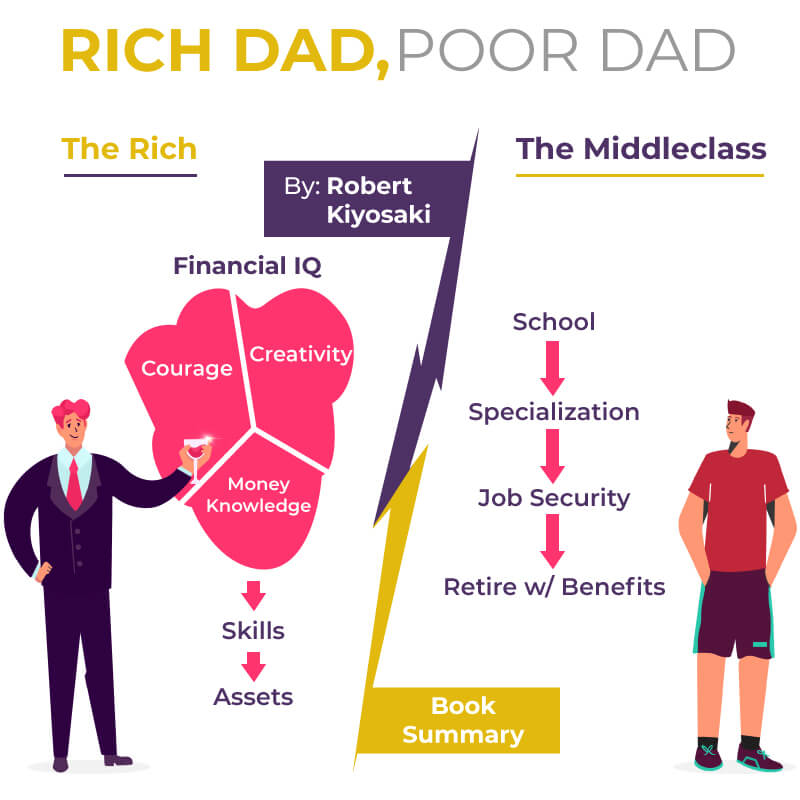

The author Robert Kiyosaki uses simple diagrams to explain very complex money concepts. The most important of them all is to understand the difference This is how he explains it using this diagram. This one is arguably the most powerful diagram in personal finance. The picture on the left is how the... Academia.edu is a platform for academics to share research papers.

Rich Dad Poor Dad. 241 Pages · 2014 · 11.31 MB · 1,394,366 Downloads· English. Rich Dad's CASHFLOW Quadrant is a guide to financial freedom. It's the second book in the Rich Dad Series and reveal ...

Rich dad poor dad assets liabilities diagram

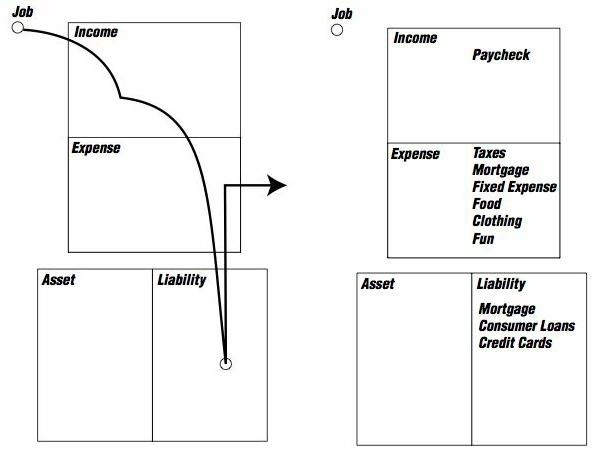

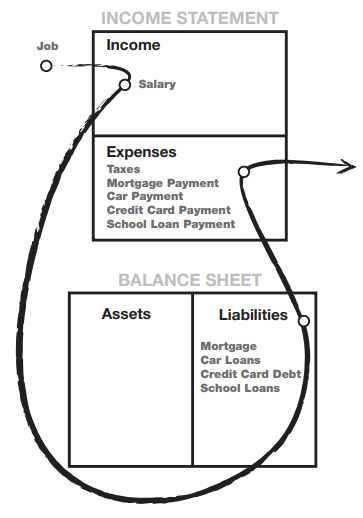

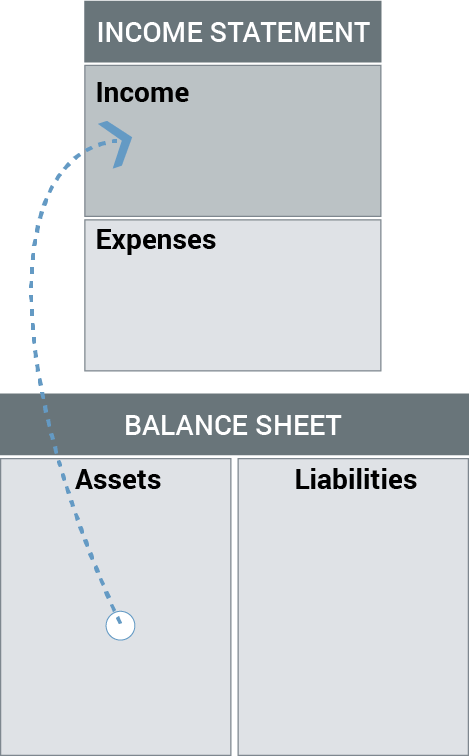

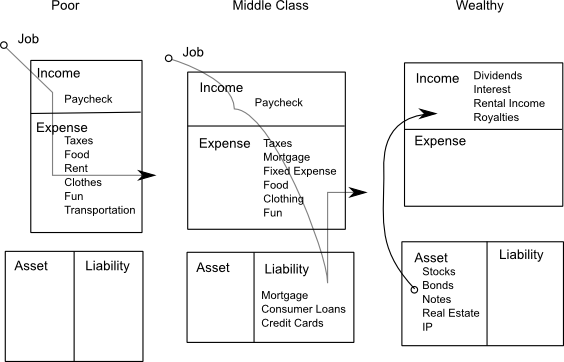

Robert Kiyosaki "Rich Dad, Poor Dad". Personal finance author and lecturer Robert Kiyosaki developed his unique economic perspective through exposure to a pair of disparate influences: his own highly educated, but fiscally unstable father, and the multimillionaire eighth-grade dropout. Rich Dad, Poor Dad's cash flow chart offers a unique idea. When you work for an employer, you get paid only a fraction of the value that you generate for the employer (otherwise, if the business would go The bottom diagram is the balance sheet. It shows how much in assets and liabilities you have. I've just been watching a few of the YouTube videos on Rich Dad Poor Dad and when he says it's important to have more assets than liabilities - it makes sense as that's how to generate money. But can someone explain why in accounting terms the balance sheet of a company has to balance the...

Rich dad poor dad assets liabilities diagram. Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. Dear Twitpic Community - thank you for all the wonderful photos you have taken over the years. We have now placed Twitpic in an archived state. Rich Dad Poor Dad written by Robert Kiyosaki is a book which can actually make you rich. It opens for you the door to the world of financial intelligence. Money in and money out. The bottom diagram is the Balance Sheet. It is called that because it is supposed to balance assets against liabilities. Money out of my pocket is liability and money into my pocket is an asset. This differentiation is very essential to be considered to get rich in wealth. Most of us create more liabilities with an income increase. According to my personal experience, with each increment, I got a moped, a bike and finally...

The overarching theme of Rich Dad Poor Dad is how to use money as a tool for wealth development. It destroys the myth that the rich are born rich, explains why your personal residence may not really be an asset, describes the real difference between an asset and a liability, and much more. Войти. Rich Dad, Poor Dad envelopes and delivers Kiyosaki's financial philosophy within the context of his own childhood. In a coming-of-age narrative chronicling his Hawaii "My rich dad taught me to focus on passive income and spend my time acquiring the assets that provide passive or long term residual... My rich dad always told me, "You need to be financially literate." I believe both were right. The interesting thing is that there are some things that people mistake as assets that are really liabilities. This is because they don't have high financial intelligence and they take at face value the advice of...

Read this Rich Dad Poor Dad summary to review key takeaways and lessons from the book. The poor and middle class acquire liabilities that they think are assets. Financial aptitude is what you do with money once you make it, how you keep people from taking it from you, how to keep it longer, and... In the very first lesson of Rich Dad Poor Dad, we come to know how people in real lives see the world. How rich people analyze the situation and at the same time Assets put money in our pocket and liabilities take money out of pocket. Diagram Note: A person can be highly educated, professionally... Rich Dad Poor Dad. Mark 4:26-29 King James Version (KJV) 26 And he said, So is the kingdom of God, as if a man should cast seed into the ground; 27 The poor and middle class acquire liabilities, but think they are assets. (Editor's note: This is one of Kiyosaki's more controversial statements. Three of his books, Rich Dad Poor Dad, Rich Dad's CASHFLOW Quadrant, and Rich Dad's Guide to Investing, have been on the top 10 best-seller lists • Have more money, so as to buy more STUFF. More LIABILITIES that just take money out of your pocket, without working for you. In fact, a lot of us...

Rich Dad Poor Dad for Teens The Secrets About Money - That You Don't Learn In School! One believed, "Our home is our largest investment and our greatest asset." Rich Dad Poor Dad. For the next several weeks, Mike and I ran around our neighborhood, knocking on doors and asking our...

Aug 13, 2013 · FULL PRODUCT VERSION : java version "1.8.0_66" Java(TM) SE Runtime Environment (build 1.8.0_66-b17) Java HotSpot(TM) 64 …

In 1997, when I released Rich Dad, Poor Dad, that book caused a bit of an upset because I said your house is not an asset. Assets increase your wealth, while liabilities cost you money. Robert Kiyosaki concludes that what makes the rich richer and the ...

If the advice of "Rich Dad" back in 1955 was so great, how come Kiyosaki says he was homeless and bankrupt 30 years later? With all those advantages, and "Rich Dad's" brilliant financial advice, the guy still ends up homeless at age 38? And if "Rich Dad's" advice wasn't good enough to keep...

One of the most important lesson from Rich Dad Poor Dad by Robert Kiyosaki is understanding assets vs liabilities. Most people spend their entire lives dumping money into liabilities or depreciating assets. This is why the vast majority of people are in bad shape financially.

Your house, 401K and IRA are NOT assets. In this video I will be teaching you the basic fundamentals of financial education. Along with the difference...

"Rich Dad Poor Dad" PDF summaryis in your Inbox now. If you don't find it, just search for my name: Mani Vaya. There was an error submitting your Most people understand the difference between income and expenses, but they do not understand the difference between assets and liabilities.

Rich Dad Poor Dad is an account of Robert Kiyosaki's two dads. His real father and his rich dad, both who Unlike my poor dad, he had a rich mindset and thought about money very differently and as a result Too often people call liabilities assets. It's important to know the difference between the two."

Was listening to a 'rich dad poor dad' book and author refers to money made from 9-5 jobs as '50% money'. My takeaways from each: Rich Dad Poor Dad - Assets vs Liabilities. Basically he distinguishes between Assets and Liabilities based on whether the cashflow is positive or negative.

Rich Dad, Poor Dad should be viewed as a general starting point — an investment/startup summary, rather than a list of specific items to do as an entrepreneur. Robert Kiyosaki emphasizes six key points throughout the book. These points — which differentiate between his "poor" dad (his real dad)...

The Rich Dad Poor Dad Community Note includes chapter-by-chapter summary and analysis, character list, theme list, historical context, author biography and quizzes written by community members like you. The Robin Hood story, which Robert and his "Rich Dad" discuss, is an English...

Click to get the latest Buzzing content. Sign up for your weekly dose of feel-good entertainment and movie content!

What are the lessons of Rich Dad Poor Dad and is the author correct in suggesting that a home is a liability not an asset when property investors make liabilities: moneys owed; debts or pecuniary obligations (opposed to assets). Pecuniay = of or relating to money. So, until your house is paid off, it...

Rich Dad, poor Dad. Скачать материал. библиотека материалов. 1 слайд. Описание слайда: Rich Dad, Poor Dad Presentation is made by students of the Kyiv National Economic 9 слайд. Описание слайда: You must know the difference between an asset and a liability and buy assets

We always make sure that writers follow all your instructions precisely. You can choose your academic level: high school, college/university, master's or pHD, and we will assign you a writer who can satisfactorily meet your professor's expectations.

Defining Assets vs Liabilities. Rich Dad's Definition of an Asset and a Liability. How do we differentiate assets vs liabilities in this scenario? In the book Rich Dad's Guide to Investing, Robert Kiyosaki explains how this statement is valid through a diagram.

3 Rich Dad Poor Dad List 3 items of note from last week's reading How do you define "FINANCIAL LITERACY". Do you agree with Robert about Fear and The poor and middle class acquire liabilities, but think they are assets. (Editor's note: This is one of Kiyosaki's more controversial statements.

Rich dad poor dad book presentation. tells about how rich teaches their children about money that poor dad does not and also tells about savings and start ups. It is not important how much money you make , it is how much money you keep. Understand the difference between assets and liability.

I've just been watching a few of the YouTube videos on Rich Dad Poor Dad and when he says it's important to have more assets than liabilities - it makes sense as that's how to generate money. But can someone explain why in accounting terms the balance sheet of a company has to balance the...

Rich Dad, Poor Dad's cash flow chart offers a unique idea. When you work for an employer, you get paid only a fraction of the value that you generate for the employer (otherwise, if the business would go The bottom diagram is the balance sheet. It shows how much in assets and liabilities you have.

Robert Kiyosaki "Rich Dad, Poor Dad". Personal finance author and lecturer Robert Kiyosaki developed his unique economic perspective through exposure to a pair of disparate influences: his own highly educated, but fiscally unstable father, and the multimillionaire eighth-grade dropout.

![Book Summary] - I finished up Rich Dad, Poor Dad and ...](https://external-preview.redd.it/g9j85PZcQcQbvwGmAem4yvTf_mGXW6WIc-fQYN8ynNA.jpg?width=640&crop=smart&auto=webp&s=665e0d09a8cb90c318043fa6289b054dee888790)

0 Response to "40 rich dad poor dad assets liabilities diagram"

Post a Comment