36 cash flow diagram calculator

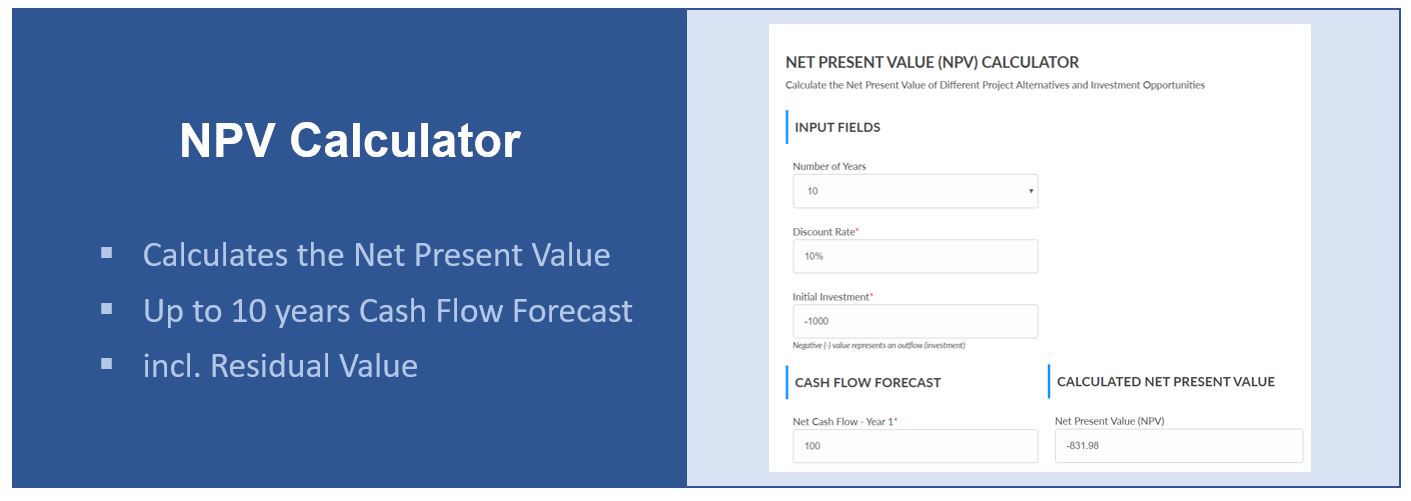

Net Present Worth (NPW) of a Cash Stream can be calculated with a discounting rate P = F0 / (1 + i)0 + F1 / (1 + i)1 + F2 / (1 + i)2 + .... + Fn / (1 + i)n (1) where P = Net Present Worth (or Value) F = cash flow in the future i = discounting rate (1 + i)n is known as the " compound amount factor ". Example - the Net Present Worth of an Investment Transaction with a variable Cash Flow Personal Cash Flow Calculator - Calculators.org - Learn ... Personal Cash Flow Calculator This calculator tool will help you examine your household's cash inflow and outflow. First input any cash inflow. This will consist of things like paychecks for both you and your spouse, tax refunds, and interest and dividend income.

Net Cash Flow Formula | Calculator (Examples with Excel ... Net Cash Flow Formula - Example #1. Let us take the example of a company DFR Ltd. which is in the business of manufacturing furniture. The senior management of the company wants to assess its cash flow during the year. The finance department provided the following details about the cash flow during the year. Cash flow from operations: $1,820,000.

Cash flow diagram calculator

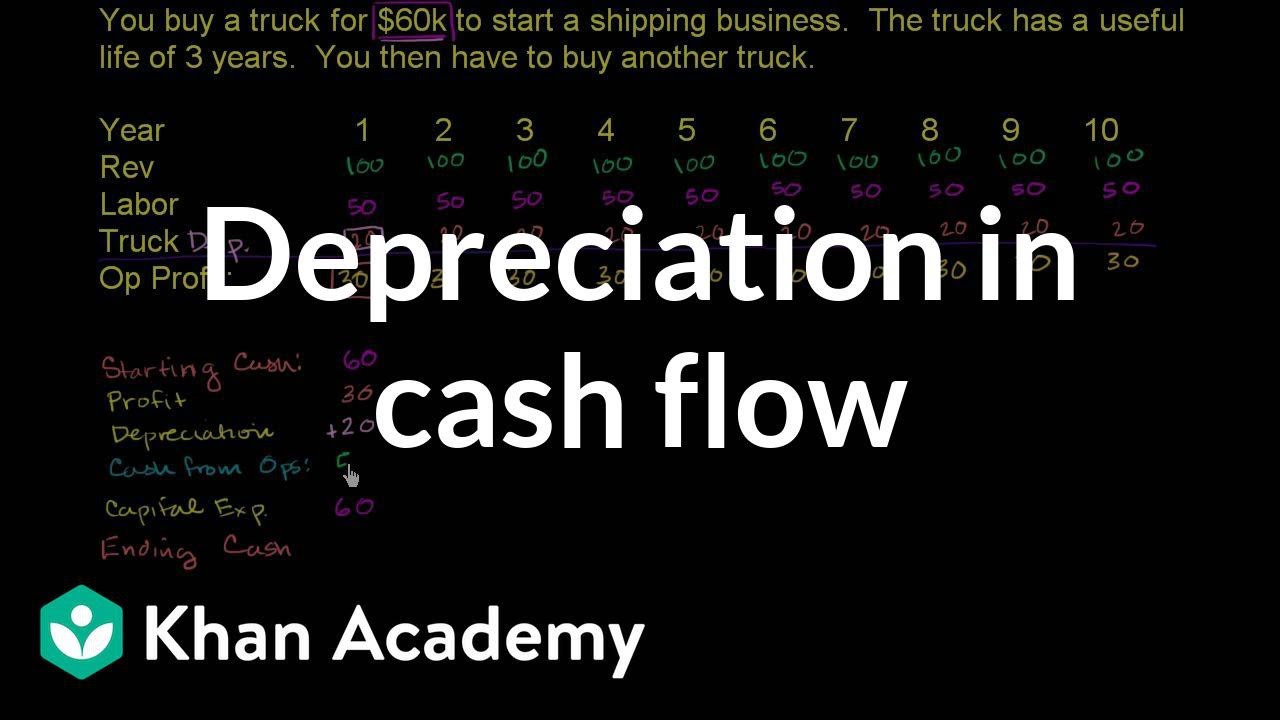

Free Cash Flow Statement Templates | Smartsheet This template allows you to conduct a discounted cash flow analysis to help determine the value of a business or investment. Enter cash flow projections, select your discount rate, and the template calculates the present value estimates. This template is a useful tool for both investors and business owners. Nonprofit Cash Flow Projection Template Future Value of Cash Flows Calculator Therefore, an additional (1 + i n) is present in each cash flow multiplication. With compounding m times per period we arrive at i n and n by setting r as the periodic rate and t as the period number to calculate i n = r/m and n = mt; we can now calculate the PV starting with the future value formula F V = P V ( 1 + r m) m t Cash Flow Formula | How to Calculate Cash Flow ... - EDUCBA Operating Cash Flow is calculated using the formula given below Operating Cash Flow = Operating Income + Depreciation & Amortization + Decrease in Working Capital - (Income Tax Paid - Deferred Tax Paid) Operating Cash Flow = $20,437 million + $10,529 million + $3,243 million - ($6,179 million - $304 million) Operating Cash Flow = $28,334 million

Cash flow diagram calculator. Free Cash Flow Template - Download Free Excel Template Free Cash Flow Template This free cash flow template shows you how to calculate free cash flow using a cash flow statement. Here is a preview of the free cash flow template: Download the Free Template Enter your name and email in the form below and download the free template now! Free Cash Flow Template Cash Flow Calculator - EquityNet Free Cash Flow. In corporate finance, free cash flow (FCF) or free cash flow to firm (FCFF) can be calculated by taking operating cash flow and subtracting capital expenditures. It is a method of looking at a business's cash flow to see what is available for distribution to the securities holders of a corporate entity. Free Cash Flow Calculator | Small Business Calculators Cash Flow Calculator. Cash flow is the lifeblood of any business, an essential asset for your company to support everyday operations. Use this calculator tool to determine whether your present cash flow is enough to cover your needs for payroll, loan payments, inventory purchases, and any other financial draws on your business resources. How to Calculate Cash Flow: The Ultimate Guide for Small ... The formula for calculating operating cash flow is as follows: Operating cash flow = Net income + Non-cash expenses - Increases in working capital Therefore, (and as shown in the chart below) to calculate operating cash flow, you'd start with the net income from the bottom of your income statement.

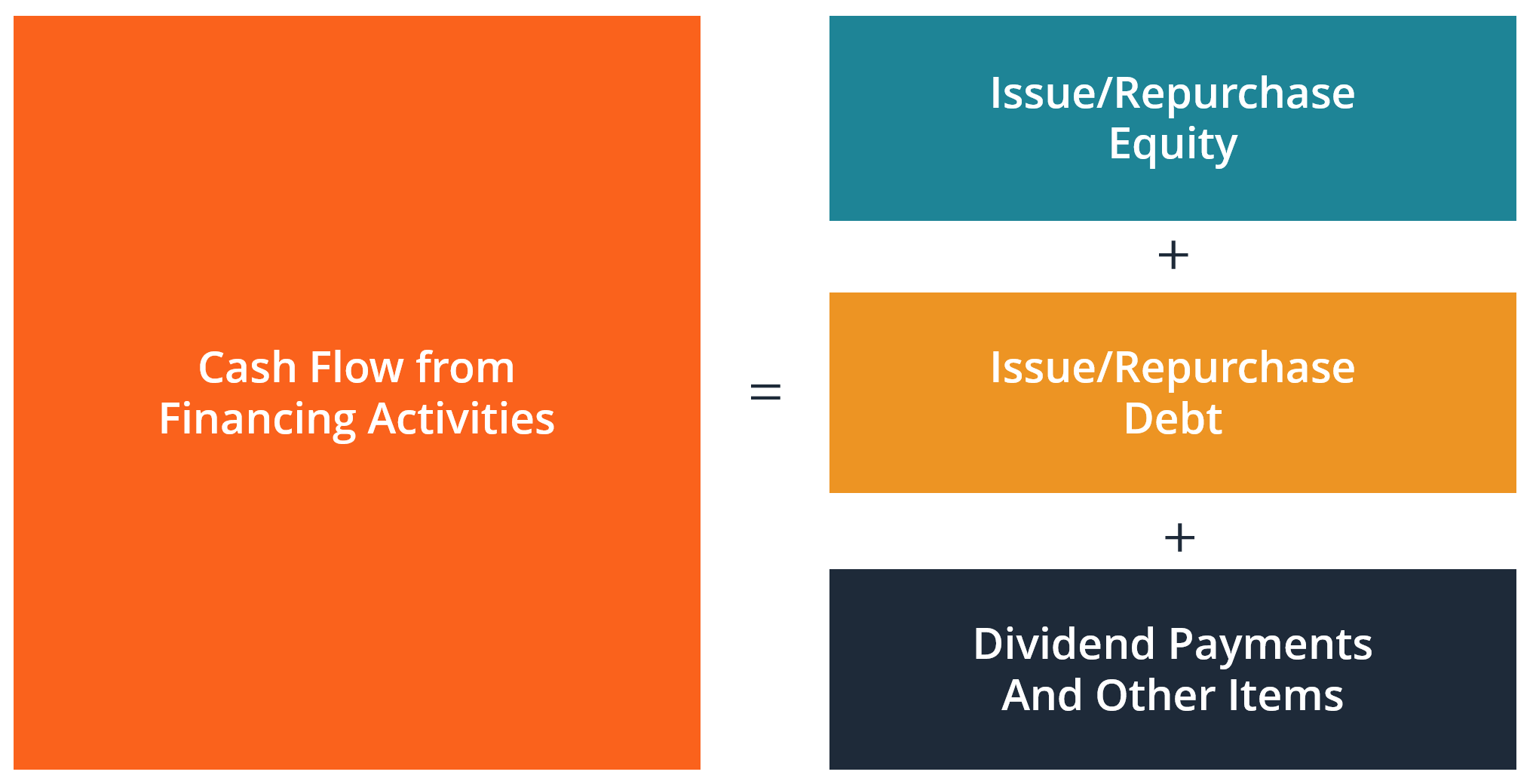

How to calculate cash flow: 3 cash flow formulas ... Free Cash Flow = Net income + Depreciation/Amortization - Change in Working Capital - Capital Expenditure Operating Cash Flow = Operating Income + Depreciation - Taxes + Change in Working Capital Cash Flow Forecast = Beginning Cash + Projected Inflows - Projected Outflows = Ending Cash Cash Flow Diagrams - Oxford University Press Cash flow diagrams visually represent income and expenses over some time interval. The diagram consists of a horizontal line with markers at a series of time intervals. At appropriate times, expenses and costs are shown. Note that it is customary to take cash flows during a year at the end of the year, or EOY (end-of-year). Present Value Of Cash Flows Calculator Using the Online Calculator to Calculate Present Value of Cash Flows Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise. A calculator will give you a detailed report about the present value of your future cash flows. These cash flows can be fixed or changing. Cash Flow - Definition, Examples, Types of Cash Flows Cash Flow (CF) is the increase or decrease in the amount of money a business, institution, or individual has. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period. There are many types of CF, with various important uses for running a business and performing financial analysis .

Cash Flow Excel Template - 13+ Free Excels Download | Free ... This is a very useful cash flow Excel template which can be used to calculate the inflow and outflow of cash for a company to calculate its net cash balance. Creating a Cash Flow Statement: Creating a cash flow can be a tough job since there are two methods you can follow- the direct and the indirect methods. Cash flow calculator - Wave Financial Cash flow calculator Use this calculator to determine if the money coming into your business (i.e. revenue and income) is enough to cover your financial obligations (i.e. payroll and other expenses) for a set period. For a business to be successful in the long term, it needs to generate profits while also being cash flow positive. Present Value of Cash Flows Calculator Calculator Use Calculate the present value ( PV) of a series of future cash flows. More specifically, you can calculate the present value of uneven cash flows (or even cash flows). To include an initial investment at time = 0 use Net Present Value ( NPV) Calculator . Periods This is the frequency of the corresponding cash flow. Solved Given the cash flow diagram below, calculate the ... 100% (1 rating) ANSWER :- 1. PW :- YEAR CASHFLOW P/F@3.7% PRESENT VALUE 2 1000 0.9299 929.9 3 1000 0. …. View the full answer. Transcribed image text: Given the cash flow diagram below, calculate the Net Present Value Total, Future Value Total, and Annual Worth Total. Cash Flow Diagram (CFD) Interest = 3.7% $538.45 $525.31 $512.50 $1k $1k $1k ...

How to Make a Cash Flow Chart? Easy to Follow Steps Let's take a look at a Cash Flow Diagram example in the real world. Imagine you run a freelance graphic design business. You want to calculate your free cash flow to determine if hiring a virtual assistant (for 10 hours a month) is financially feasible. Let's assume the data below represents the financial position of your freelance business.

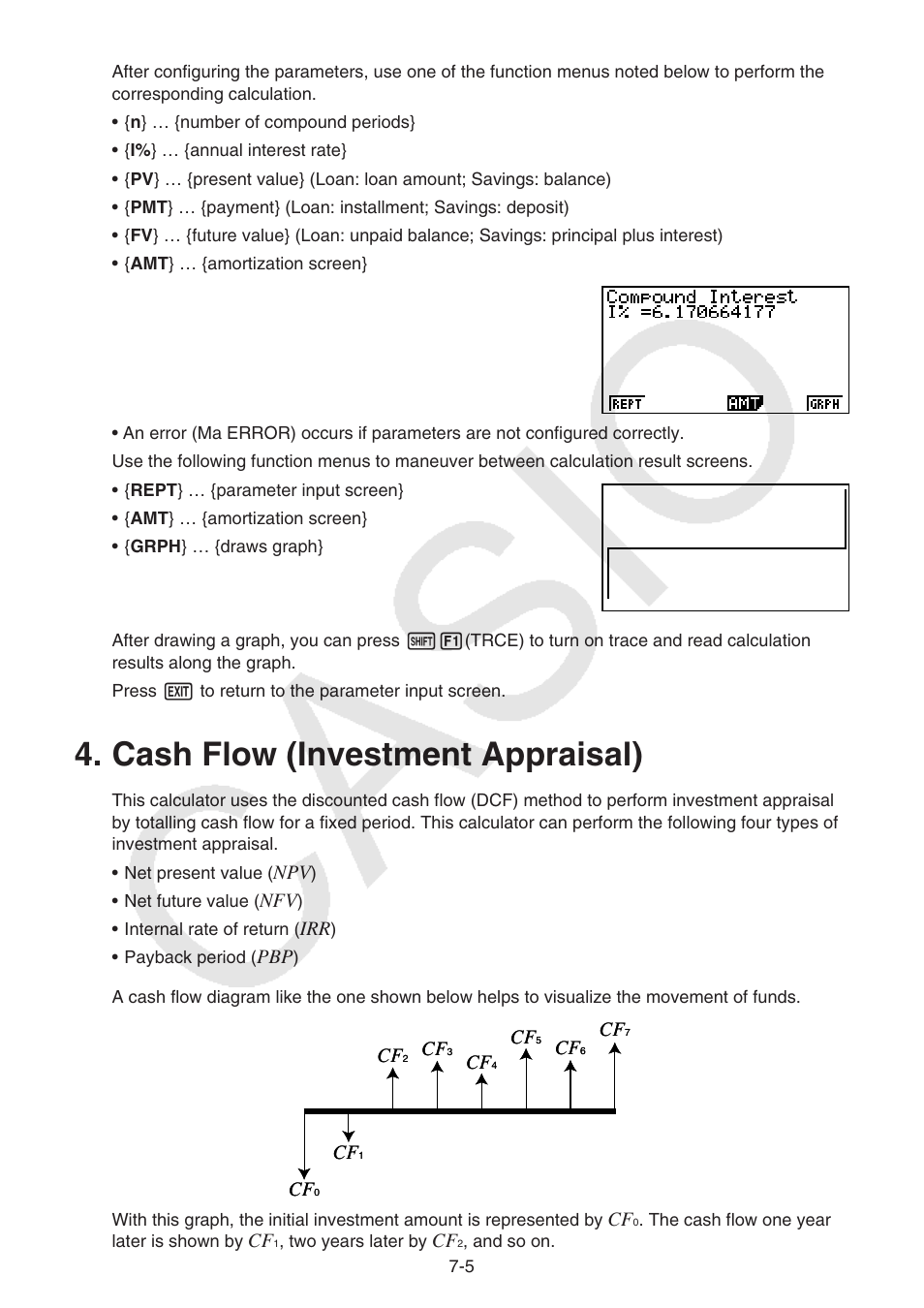

PDF Cash Flow and Equivalence - University of Idaho The standard cash flows are single payment cash flow, uniform series cash flow, and gradi ent series cash flow. A single payment cash flow can occur at the beginning of the time line (designated as t = 0), at the end of the time line (designated as t= n), or at any time in between. The uniform series cash flow, illustrated in Fig. 51.2,

Cash Flow Calculator Cash Flow Calculator Cash Flow Calculator Sales & Profits Total Sales From First Month How much will sales grow each month? What percentage of sales will be spent on the products you sell? (Cost of Goods Sold) What percentage of sales will be spent on operational expenses? Starting Balances

Retirement Cash Flow Calculator - Chalk Your Future Retirement Savings and Cash flow during Retirement This calculator calculates the amount of money you can withdraw in retirement. Cash you have now ($)* Investment return (%)* The average return from stock market is 5% in the long run. Time horizon (years)* In how many years do you want to start withdrawing money from Retirement accounts?

Cash Flow Diagram Generator - The Spreadsheet Page Our Cash Flow Diagram Generator is an excellent tool for displaying business financial results both numerically and visually. Rationale for Graphic Representation Most business owners utilize a variety of programs and spreadsheets to forecast, calculate, and record the results of their business activities.

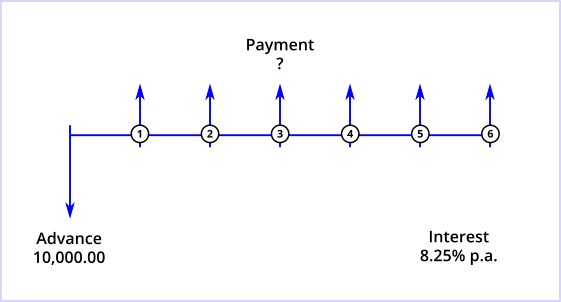

Cash Flow Diagrams - Engineering ToolBox Present Value cash flow flow calculator Cash Flow Diagram - Investment Transaction An investment transaction starts with a negative cash flow when the investment is done - and continuous with positive cash flows when receiving the pay backs. upward arrows - positive cash flows (pay back) downward arrows - negative cash flow (investing)

Operating Cash Flow Calculator - The Spreadsheet Page Our Operating Cash Flow Calculator is a critical tool that will help you track, gauge the effectiveness of, and understand the impact of your business's core activities. We stress "core" here because nearly all legitimate business activities use or generate cash. But only a subset of those activities relates to the core operation of the business.

Free Cash Flow Calculator - Calculators.org - Learn Math ... To calculate FCF, get the value of operational cash flows from your company's financial statement. This figure is also referred to as 'operating cash.' Then subtract capital expenditure, which is money required to sustain business operations, from its value. See the formula below: FCF = Cash from Operations - Capital Expenditure

Cash Flow Calculator - NASE Cash Flow Calculator. Having adequate cash flow is essential to keep your business running. If you run out of available cash, you run the risk of not being able to meet your current obligations such as your payroll, accounts payable and loan payments. Use this calculator to help you determine the cash flow generated by your business.

Cash flow statement - templates.office.com Cash flow statement. Analyze or showcase the cash flow of your business for the past twelve months with this accessible cash flow statement template. Sparklines, conditional formatting, and crisp design make this both useful and gorgeous. Streamline your budgeting with this sample cash flow statement template.

Importance of Cash Flow Diagram - Engineering The cash flow diagram is the most important and essential element of financial analysis. A proper and accurate cash flow diagram should be constructed and tested before an attempt is made to perform the financial analysis. Indeed, with today's special handheld calculators and personal computer spreadsheets, the financial analysis is completed ...

Cash Flow Formula | How to Calculate Cash Flow ... - EDUCBA Operating Cash Flow is calculated using the formula given below Operating Cash Flow = Operating Income + Depreciation & Amortization + Decrease in Working Capital - (Income Tax Paid - Deferred Tax Paid) Operating Cash Flow = $20,437 million + $10,529 million + $3,243 million - ($6,179 million - $304 million) Operating Cash Flow = $28,334 million

Future Value of Cash Flows Calculator Therefore, an additional (1 + i n) is present in each cash flow multiplication. With compounding m times per period we arrive at i n and n by setting r as the periodic rate and t as the period number to calculate i n = r/m and n = mt; we can now calculate the PV starting with the future value formula F V = P V ( 1 + r m) m t

Free Cash Flow Statement Templates | Smartsheet This template allows you to conduct a discounted cash flow analysis to help determine the value of a business or investment. Enter cash flow projections, select your discount rate, and the template calculates the present value estimates. This template is a useful tool for both investors and business owners. Nonprofit Cash Flow Projection Template

0 Response to "36 cash flow diagram calculator"

Post a Comment