39 intentionally defective grantor trust diagram

Contribute to btraas/java development by creating an account on GitHub. This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. Intentionally defective irrevocable trusts are sometimes called intentionally defective grantor trusts. These are two names for the same arrangement. Any income, gain, and deduction items related to the IDIT's assets are reported on your personal federal income tax returns, because you are still considered to own the assets for federal income ...

Despite its odd name, the intentionally defective grantor trust (IDGT) is a powerful estate planning tool that can achieve a wide range of objectives: reducing the size of the grantor's estate, transferring assets outside the probate process, removing assets from the reach of the grantor's creditors, and reducing the future tax liability upon transfer or sale of an appreciating asset.

Intentionally defective grantor trust diagram

Intentionally Defective Grantor Trust (IDGT) for Dummies. Paul Sundin, CPA| August 3, 2021. The IDGT is a technique for enhancing the wealth transfer benefits of gifts otherwise made for estate planning purposes. The Internal Revenue Code contains a series of provisions, known as the grantor trust rules. These rules were initially designed to ... intentionally defective grantor trust (IDGT) is a complete transfer to a trust for transfer tax purposes but an incomplete, or "defective," transfer for income tax purposes. Because the trust is irrevocable for estate and gift purposes and the grantor has not retained any powers Appropriately enough, it's called the "intentionally defective grantor trust" (IDGT). How the trust works. An IDGT is treated as a separate tax entity for federal estate tax purposes. However, the trust is considered to be a grantor trust for income tax purposes. If certain requirements are met, it can be a powerful vehicle for affluent ...

Intentionally defective grantor trust diagram. Intentionally Defective Grantor Trust Diagram search trends: Gallery Why we will continue to love irrevocable sale gift in 2016 High quality photo of sale gift make Beautiful image of gift make gift tax Don't Get make gift tax death yet, first read this Probably the best picture of gift tax death tax that we could find INTENTIONALLY DEFECTIVE GRANTOR TRUSTS I. INTRODUCTION AND CIRCULAR 230 NOTICE A. Introduction. This Memorandum discusses how an estate freeze may be achieved through the sale of assets, particularly ownership interests in a family entity such as a family limited liability company, to an intentionally defective grantor trust ("IDGT"). Make sure the information you add to the Intentionally Defective Grantor Trust Form is updated and accurate. Indicate the date to the form using the Date option. Click on the Sign icon and create a signature. You can use 3 options; typing, drawing, or uploading one. Check every field has been filled in correctly. 6 Common Techniques Involving Grantor Trusts The basic transaction is a transfer of an asset to a children's trust, in which the children's trust is a grantor trust. Instead of, or in addition to, a children's trust there might be a (i) grandchildren's trust; (ii) dynasty trust; and (iii) completed

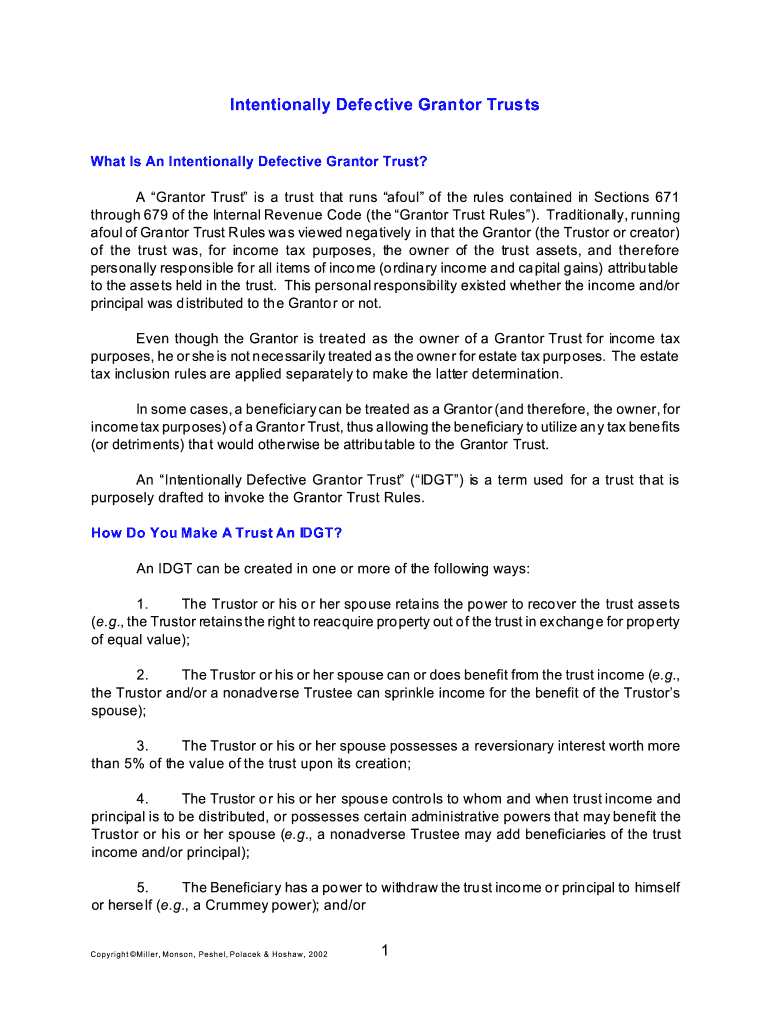

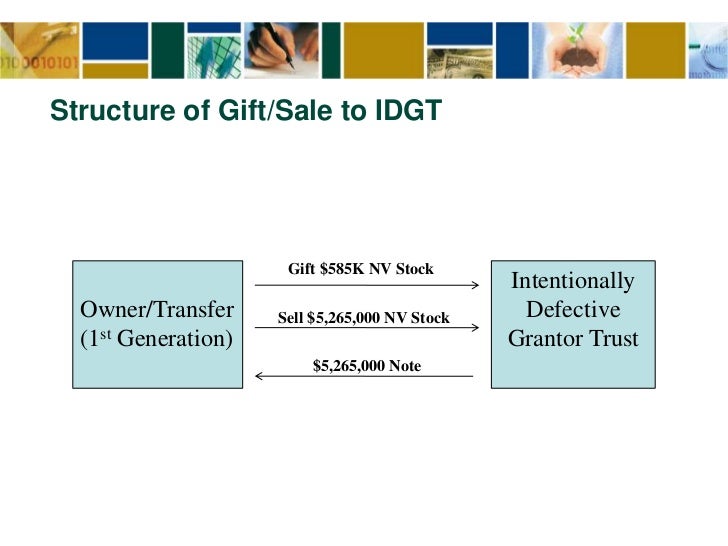

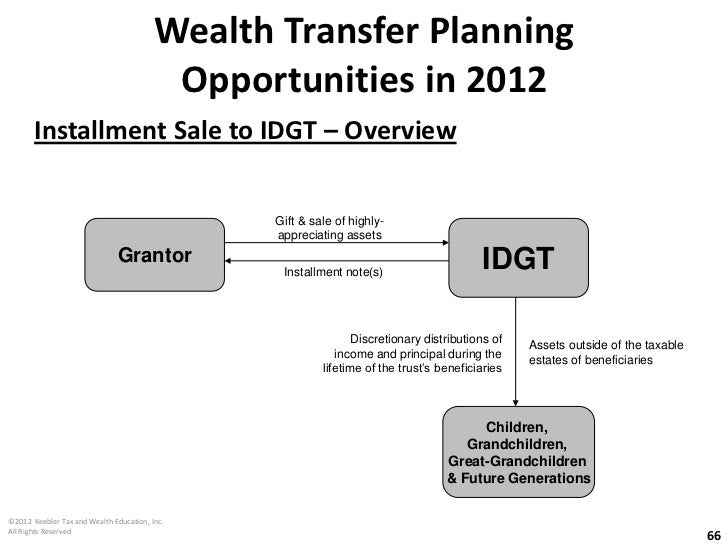

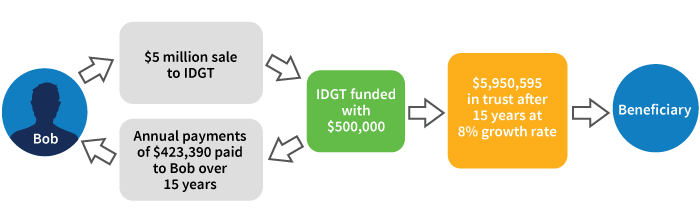

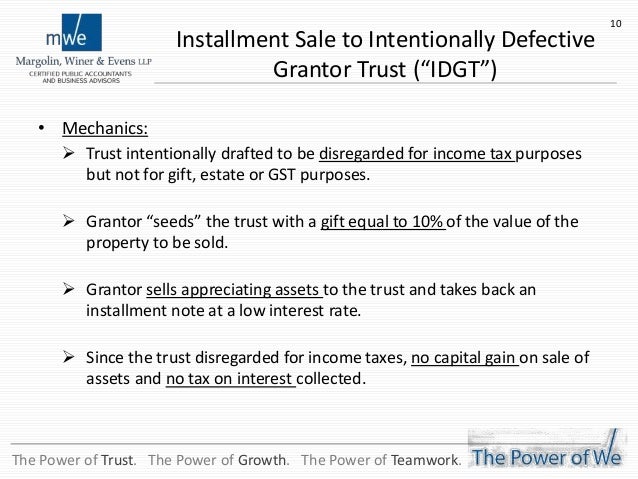

In the "typical" Intentionally Defective Grantor Trust transaction, the grantor makes a "seed money" gift to the trust, then sells additional property to the trust (See Form B) at fair market value (possibly discounted) in exchange for an interest-bearing installment note (See Form C). The sale is not a taxable event to the grantor (See ... "Intentionally defective grantor trust" (IDGT) describes a type of irrevocable trust where trust income is treated as the grantor's for income tax purposes, but assets of the trust are not treated as the grantor's property for estate tax purposes. The strategy is also sometimes known as an Intentionally Defective Irrevocable Trust (IDIT) as well. A popular estate planning vehicle for transferring wealth to descendants during one's lifetime is the "intentionally defective grantor trust" (IDGT), also referred to as an "intentionally defective irrevocable trust" (IDIT). Through this type of irrevocable trust, transferors can significantly increase the amount they shield from ... The Spousal Lifetime Access Trust, or "SLAT", is simply an intentionally defective grantor trust where the Grantor's spouse is a permissible beneficiary of the trust along with descendants. By including her spouse as beneficiary, the Grantor is able to transfer assets to an irrevocable IDGT but still ensure that the spouse has access to ...

such as an Intentionally Defective Grantor Trust, a 678 Trust, or a Spousal Lifetime Access Trust. › George and Sarah chose to create an Intentionally Defective Grantor Trust to benefit their children (the "Children's Trust") and fund it by making gifts to the trust using a portion of each spouse's lifetime gift tax called an "Intentionally Defective Grantor Trust" • Name came about because a "defect" in the trust causes its income to be taxed to the grantor (apparently an outcome many think should be avoided) • The actual IRS term used to refer to such a trust is "grantor trust." 6 . An intentionally defective grantor (IDGT) allows a trustor to isolate certain trust assets in order to segregate income tax from estate tax treatment on them. It is effectively a grantor trust with... definition of - senses, usage, synonyms, thesaurus. Online Dictionaries: Definition of Options|Tips

a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ...

Land Surveyor Dictionary -Glossary of terms related to geomatics and land surveying. Have quick access to the dictionary inside our Mobile Surveying Glossary app.

An intentionally defective grantor trust ("IDGT") is a trust whose income is taxed to the grantor but whose contributed assets are excluded from the grantor's estate for estate tax purposes. The word "defective" is an historical misnomer as there is nothing defective about these trusts. The IDT accomplishes four goals:

Similar to a grantor retained annuity trust (GRAT), the sale to an IDIT technique produces an estate tax savings if the assets sold to the IDIT generate a total ...16 pages

Mar 3, 2020 — Intentionally Defective Grantor. Trust (IDGT) Sale. • An IDGT sale is a transaction whereby a grantor sells a highly-.113 pages

To fund intentionally defective grantor trusts, grantors have two options: make a completed gift to the trust or engage in an installment sale to the trust. A completed gift. Gifts are the most common way to fund an IDGT. The grantor makes an irrevocable, completed gift of the desired assets to the trust. Gifting appreciating assets reaps the ...

The trust is defective because the grantor still pays income taxes on the income generated by the trust, even though the assets are no longer part of the estate. It seems like that would be a mistake, hence the term "defective." However, there is a reason for that. The creation of an IDGT trust freezes the assets in the trust.

Another benefit to creating a dynasty trust during the lifetime of the Grantor is because the trust can be set up as an Intentionally Defective Grantor Trust (IDGT). An IDGT The benefit to this is that the Grantor can pay the taxes on the trust with his own money, allowing the trust to grow at a faster rate.

(a) Intentionally Defective Irrevocable Grantor Trusts - General considerations (1) Understand the difference between Code Sections 2031 through 2042 and Code Sections 671 through 679 (2) Estate tax includability is governed by Code Sections 2031 through 2042. (3) Grantor trust rules are governed by IRC § 671 through 679.

May 9, 2017. by. Daniel Evans. July 27, 2018. Up until the Tax Reform Act of 1986, grantor trust status was something to be avoided, but thanks to rulings by the Internal Revenue Service, intentionally creating a grantor trust is now an accepted estate and gift tax planning strategy. This article will explain the principles of grantor trusts ...

UNK the , . of and in " a to was is ) ( for as on by he with 's that at from his it an were are which this also be has or : had first one their its new after but who not they have – ; her she ' two been other when there all % during into school time may years more most only over city some world would where later up such used many can state about national out known university united then made ...

data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAACs0lEQVR4Xu3XMWoqUQCG0RtN7wJck7VgEW1cR3aUTbgb7UUFmYfpUiTFK/xAzlQWAz/z3cMMvk3TNA2XAlGBNwCj8ma ...

Oct 18, 2021 — An intentionally defective grantor trust (“IDGT”) can be beneficial for transferring wealth and reducing estate taxes.Missing: diagram | Must include: diagram

Sections 2036-2042 and the grantor trust income tax rules of IRC Sections 671-678. An IDGT is an irrevocable trust that effectively removes assets from the grantor's gross estate. For income tax purposes, however, the trust is "defective", and the grantor is taxed on the trust's income.

Installment sales to intentionally defective (grantor) irrevocable trusts (IDITs) have long been a popular estate-planning tool. 1 In a typical IDIT sale, the seller establishes, funds and then ...

is a grantor trust for income tax purposes, the INTENTIONALLY DEFECTIVE GRANTOR TRUSTS sale of the asset would not result in any taxable gain to the grantor (for income tax purposes, the grantor is considered to be selling an asset to him or herself). There also is no interest in come reported by the grantor or interest deduc tion to the IDGT.

Intentionally Defective Grantor Trust: What is It? An IDGT is an irrevocable trust that is often created for the benefit of the grantor's spouse or descendants. This trust planning instrument allows the grantor to transfer investment assets to family members during the life of the grantor. The term "defective" in the trust's name refers ...

Jun 30, 2020 — A sale to an intentionally defective grantor trust is one vehicle which works well to transfer wealth in the current low-interest-rate ...

Intentionally defective grantor trusts (IDGTs) ... In contrast, a grantor trust is one whose income is taxed to the grantor of the trust rather than the trust itself. In other words, the person funding the trust (i.e., the grantor) is treated as the owner for federal and state income tax purposes. As such, a separate income tax return usually ...

Intentionally Defective Grantor Trusts (IDGTs) are the premier vehicles for affluent families to transfer their wealth to the next generation. An IDGT is an irrevocable trust created by an individual (the "grantor") during life. Assets transferred to an IDGT (cash, marketable securities, interest in a closely held business, etc.) exist outside ...

The trust also allows the grantor the opportunity to remove future appreciation from the grantor's estate while maintaining control over the assets. Defective Powers The most common powers that are retained by the grantor and thus make the trust defective for income tax purposes include:

a aachen aardvark aardvarks aaron aba ababa abaci aback abactor abactors abacus abacuses abaft abalone abandon abandoned abandonee abandonees abandoning abandonment ...

Appropriately enough, it's called the "intentionally defective grantor trust" (IDGT). How the trust works. An IDGT is treated as a separate tax entity for federal estate tax purposes. However, the trust is considered to be a grantor trust for income tax purposes. If certain requirements are met, it can be a powerful vehicle for affluent ...

intentionally defective grantor trust (IDGT) is a complete transfer to a trust for transfer tax purposes but an incomplete, or "defective," transfer for income tax purposes. Because the trust is irrevocable for estate and gift purposes and the grantor has not retained any powers

Intentionally Defective Grantor Trust (IDGT) for Dummies. Paul Sundin, CPA| August 3, 2021. The IDGT is a technique for enhancing the wealth transfer benefits of gifts otherwise made for estate planning purposes. The Internal Revenue Code contains a series of provisions, known as the grantor trust rules. These rules were initially designed to ...

0 Response to "39 intentionally defective grantor trust diagram"

Post a Comment